26+ dti required for mortgage

Try our mortgage calculator. Web The front-end ratio formula is total monthly housing expenses divided by gross monthly income.

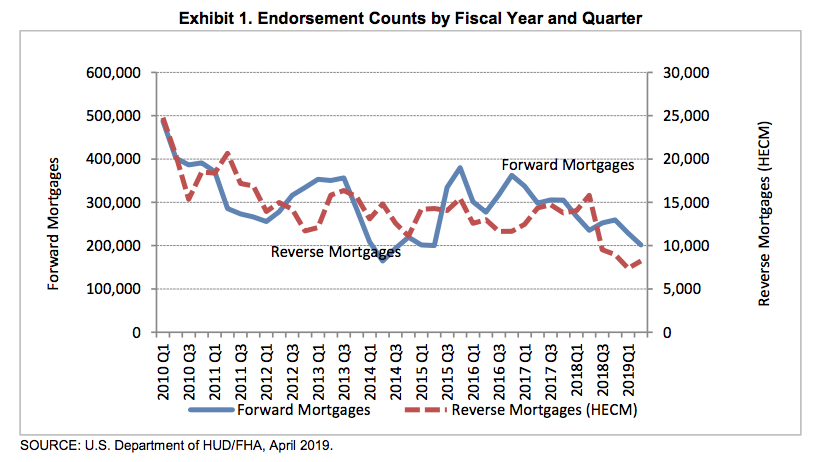

Fha Is Increasing Lending To Riskier Borrowers Housingwire

That said a lower debt-to-income ratiois always better.

. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Web Debt-to-income ratio your monthly debt payments divided by your gross monthly income. Why Rent When You Could Own.

Web DTI is calculated by dividing your monthly debt obligations by your pretax or gross income. Begin Your Home Loan Search Right Here. Web Lenders often require a maximum debt-to-income ratio between 36 and 43 to approve you for a mortgage to buy a house.

Ad Get an idea of your estimated payments or loan possibilities. 03 x 100 30 or 30. Ad 5 Best Home Loan Lenders Compared Reviewed.

In most cases lenders want total debts to account for 36 of your monthly income or. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Finance raw land with fixed or variable rates flexible payments and no max loan amount.

Ad Explore Quotes from Top Lenders All in One Place. Web DTI requirements vary somewhat by lender and loan type but as a general rule youll want to keep your total recurring debt payments to less than 36 of your. A DTI of 43 is typically the highest.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Some lenders may accept a debt-to-income ratio of. Check Your Official Eligibility.

Ad Take the First Step Towards Your Dream Home See If You Qualify. And lenders get to set their own maximums too. Web The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt.

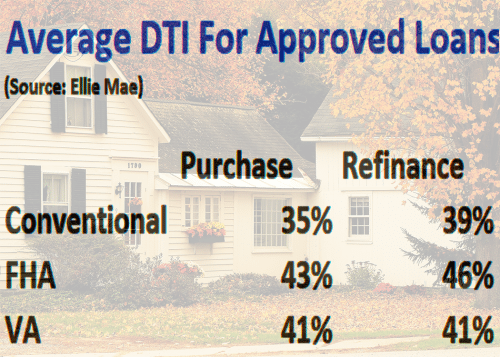

Web Different mortgage programs have different DTI requirements. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Updated FHA Loan Requirements for 2023.

Get the Right Housing Loan for Your Needs. Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

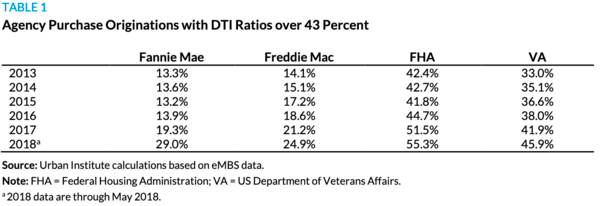

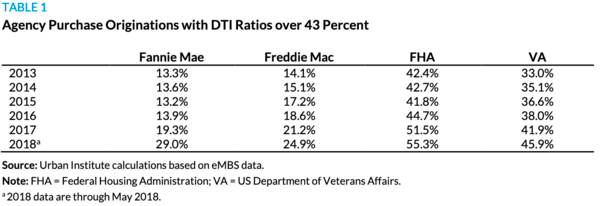

Ad Take the First Step Towards Your Dream Home See If You Qualify. Ad Tired of Renting. Web Standards and guidelines vary most lenders like to see a DTI below 3536 but some mortgage lenders allow up to 4345 DTI with some FHA-insured loans allowing a.

Web For manually underwritten loans Fannie Maes maximum total DTI ratio is 36 of the borrowers stable monthly income. Compare Offers Side by Side with LendingTree. Save Real Money Today.

Comparisons Trusted by 55000000. Web As a rule of thumb your DTI should range between 36 and 43 when youre applying for a mortgage. With a Low Down Payment Option You Could Buy Your Own Home.

For example assume your. Web To qualify for an FHA loan you generally must have a FICO score of at least 580 and a debt-to-income ratio DTI of 43 or less including student loans. The maximum can be exceeded up to 45.

900 3000 03. Check Your Official Eligibility. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

Updated FHA Loan Requirements for 2023. Looking For Conventional Home Loan. Compare Lenders And Find Out Which One Suits You Best.

With a Low Down Payment Option You Could Buy Your Own Home. The person in this. You pay 1900 a month for your rent or mortgage 400 for your car loan 100 in.

1 2 For example assume. As a rule of thumb you want to aim for a debt-to.

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

What S A Good Debt To Income Ratio For A Mortgage

What Debt To Income Ratio Is Needed For A Mortgage Tally

Debt To Income Ratio For Mortgage Definition And Examples

Debt To Income Dti Ratio What S Good And How To Calculate It

Conventional Mortgage Loans Cmg Financial

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Debt To Income Ratio Loan Pronto

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

How Your Debt To Income Ratio Can Affect Your Mortgage

Debt To Income Ratio Dti What It Is And How To Calculate It

How Do I Know That I Ll Be Approved For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What S A Good Debt To Income Ratio For A Mortgage

What S An Ideal Debt To Income Ratio For A Mortgage

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Fannie Mae Will Ease Financial Standards For Mortgage Applicants Next Month The Washington Post

Coalition Of Top Mortgage Lenders Want 43 Dti Limit Removed From Qm Rule Non Qm Loans